Risk Profile – Growth Investor

The investment objective of a Growth investor is to place an emphasis on long term growth with a modest income stream.

A Growth portfolio looks to invest around 85% in growth assets (eg equities and property) and the remainder in defensive assets (eg cash and fixed income). The figure of 85% is a general benchmark; actual allocations over time will vary around this as investment conditions change and investment managers take opportunities to improve returns.

This portfolio suits investors who are willing to accept high levels of investment value volatility in return for high potential investment performance. The higher exposure to growth assets means that capital stability is only a minor concern.

Such a portfolio is suitable for investors with a long term investment time frame. It is important to note that the value of your capital can move up and down over time, particularly in shorter time spans. Hence these investments should be considered with a minimum timeframe of 5 years.

| Investment objectives – Growth | |

| Minimum investment period | 5 years |

| Returns | |

| Forecast average annual return over 10 years | 7.2% |

| Risk | |

| Probability of a negative return over a single year | 20.8% |

| Expected negative years out of 20 | 4.2 |

| Forecast rate of returns | |

| 1 year | -9.5% to 28.9% |

| 5 years (per annum) | -0.4% to 14.9% |

| 10 years (per annum) | 1.9% to 12.5% |

| 20 years (per annum) | 4.4% to 11.6% |

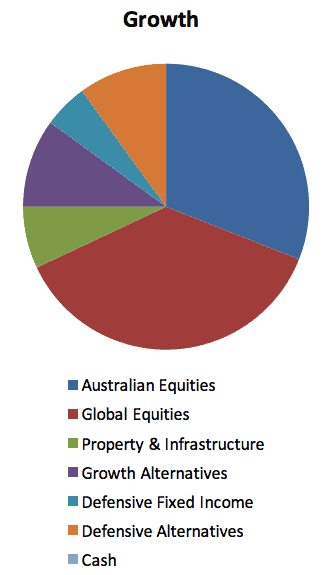

| Asset allocation – Growth | Target % | Minimum % | Maximum % |

| Defensive Fixed Income | 4 | 0 | 20 |

| Defensive Alternatives | 8 | 0 | 25 |

| Cash | 3 | 0 | 15 |

| Total defensive | 15 | 5 | 25 |

| Australian Equities | 31 | 20 | 60 |

| Global Equities | 37 | 20 | 60 |

| Property & Infrastructure | 7 | 0 | 30 |

| Growth Alternatives | 10 | 0 | 20 |

| Total growth | 85 | 75 | 95 |