Posts by Gerard Haskew

How Much Do You Need to Retire in Australia?

Discover how much you need to retire comfortably in Australia. Leading Advice guides you with expert tips for a secure financial future.

Read MoreHow Forced Saving Plans Help Families Stay Financially Disciplined

Forced saving plans can transform your family’s financial habits. Discover smart tips to stay disciplined and reach goals with Leading Advice.

Read MoreA Trump Presidency

What does a Trump presidency mean for your portfolio? Get expert analysis and actionable financial advice. Click to read.

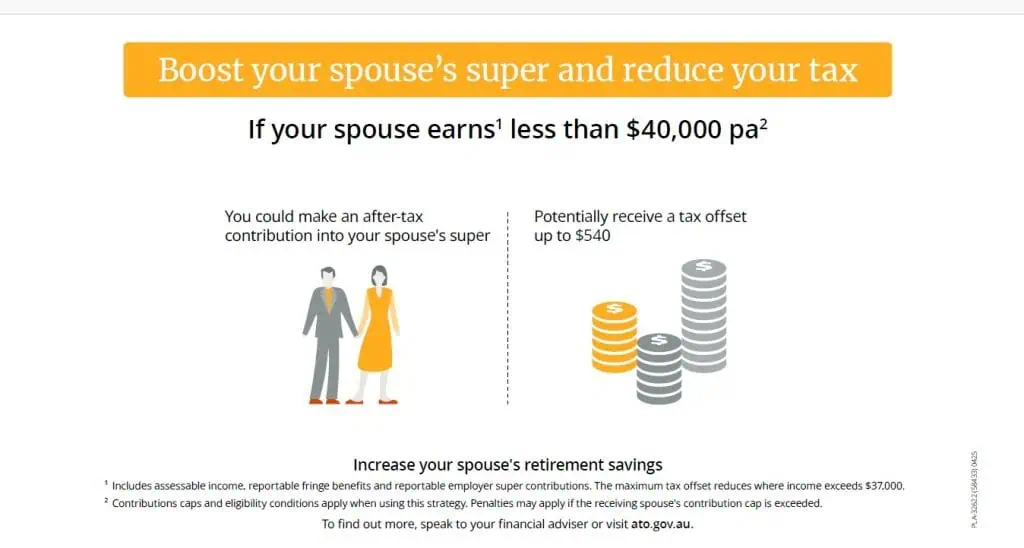

Read MoreSuper strategies – Splitting your super contributions to your spouse

Splitting super contributions to your spouse’s super account may help to boost their retirement savingsand provide a range of other benefits. How does the strategy work? You may be able to split (transfer) eligible concessional contributions (CCs) that you’ve made or received to your spouse’s super account. Eligible CCs include employer super contributions and personal…

Read MoreSuper strategies – Topping up super with ‘catch-up’ contributions

If you have not fully used your concessional cap in a prior financial year, youmay be eligible to use these unused carried forward amounts in a later year.Depending on your circumstances, this could help you to maximise tax‑effective super contributions and invest more for retirement. How does the strategy work? If your concessional contributions (CCs)…

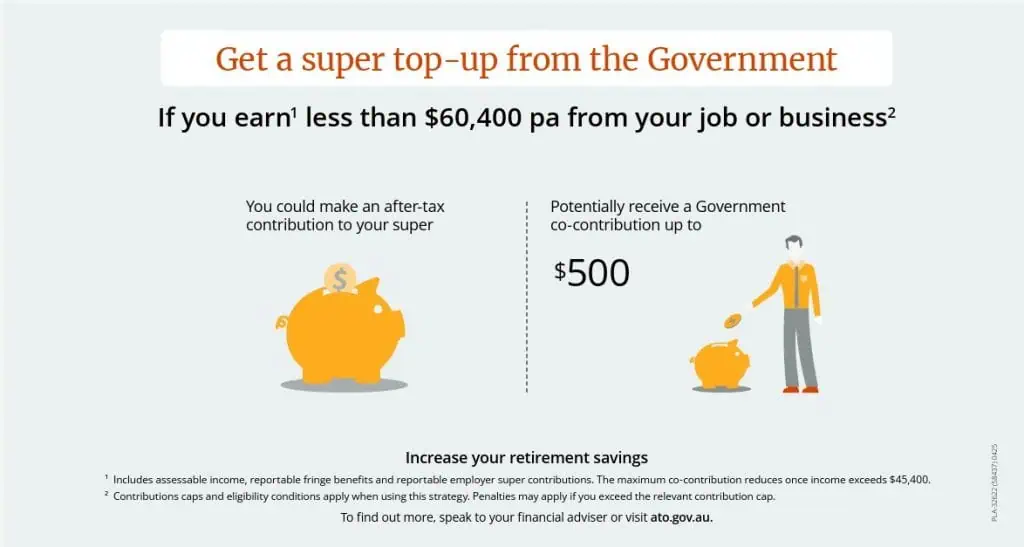

Read MoreSuper strategies – Top-up your super with help from the Government

If your income is under a certain threshold, then making personal after-tax super contributions could enable you to qualify for a Governmentco-contribution and take advantage of the low tax rate payable in super on investment earnings. How does the strategy work? If you are under 71 at the end of the financial year, earn1 less…

Read MoreSuper strategies – Sacrifice pre-tax salary into super

Contributing some of your pre‑tax salary, wages or a bonus into super could help you to reduce your tax and invest more for your retirement. How does the strategy work? With this strategy, known as salary sacrifice, you need to arrange for your employer to contribute some of your pre‑tax salary, wages or bonus directly…

Read MoreFederal Election 2025 – What this could mean for you and your finances?

During the Federal Election campaign, the Government made a number of election promises, which may impact finances. There were also a number of support measures proposed in the recent Federal Budget. What could this mean for you? These announcements are proposals only and may or may not be made law. The information below, including the…

Read MoreHOW TO THRIVE IN UNCERTAIN MARKETS

Understanding Market Volatility Market volatility is an inevitable part of investing, yet it often evokes fear and uncertainty among investors. The phrase “catching a falling knife” vividly captures the dangers of trying to time the market during sharp declines it suggests that attempting to buy assets during a precipitous drop can lead to painful losses.…

Read MoreIncome Protection: New Job, New Income

If I get a new job within the same industry, can I increase my income protection without going through underwriting? Some income protection policies include a guaranteed future insurability or benefit indexation feature, which may allow you to increase your cover without full medical underwriting particularly if your income increases. However, this typically depends on…

Read More