Financial Planning

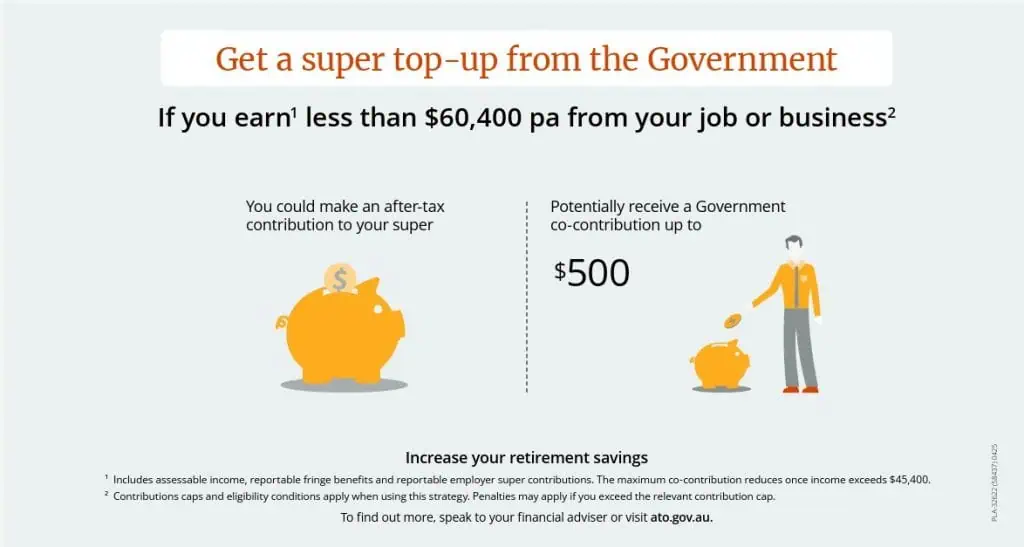

Super strategies – Top-up your super with help from the Government

If your income is under a certain threshold, then making personal after-tax super contributions could enable you to qualify for a Governmentco-contribution and take advantage of the low tax rate payable in super on investment earnings. How does the strategy work? If you are under 71 at the end of the financial year, earn1 less…

Read MoreSuper strategies – Sacrifice pre-tax salary into super

Contributing some of your pre‑tax salary, wages or a bonus into super could help you to reduce your tax and invest more for your retirement. How does the strategy work? With this strategy, known as salary sacrifice, you need to arrange for your employer to contribute some of your pre‑tax salary, wages or bonus directly…

Read MoreFederal Election 2025 – What this could mean for you and your finances?

During the Federal Election campaign, the Government made a number of election promises, which may impact finances. There were also a number of support measures proposed in the recent Federal Budget. What could this mean for you? These announcements are proposals only and may or may not be made law. The information below, including the…

Read MoreHOW TO THRIVE IN UNCERTAIN MARKETS

Understanding Market Volatility Market volatility is an inevitable part of investing, yet it often evokes fear and uncertainty among investors. The phrase “catching a falling knife” vividly captures the dangers of trying to time the market during sharp declines it suggests that attempting to buy assets during a precipitous drop can lead to painful losses.…

Read MoreIncome Protection: New Job, New Income

If I get a new job within the same industry, can I increase my income protection without going through underwriting? Some income protection policies include a guaranteed future insurability or benefit indexation feature, which may allow you to increase your cover without full medical underwriting particularly if your income increases. However, this typically depends on…

Read MoreSuperannuation Beneficiaries

Can I nominate my siblings to receive my superannuation when I die? can only nominate your siblings in a binding death benefit nomination if they meet the definition of a depen- dent under superannuation law at the time of your death. This means they would need to be financially dependent on you, in an interdependent…

Read MoreHome Equity Access Scheme (HEAS)

My friend mentioned they’re using the Home Equity Access Scheme (HEAS) to help fund their retirement. What is it, and how much can I get from it? The Home Equity Access Scheme (HEAS) is a government initiative that allows eligible older Australians to supple- ment their retirement income by unlocking equity in their home or…

Read MoreTAX CUTS, HOUSING SUPPORT, AND HEALTHCARE REFORMS

WHAT THE FEDERAL BUDGET MEANS FOR YOUR WEALTH 1. Introduction: Framing the Federal Budget’s Impact on Australians The 2025-26 Australian Federal Budget has been un- veiled, marking a pivotal moment for households, busi- nesses, and the broader economy. With a strong emphasis on addressing cost-of-living pressures, enhancing housing affordability, and improving healthcare access, this budget…

Read MoreNavigating Financial Risks and Retirement

Introduction: The Changing Perception of Life Expectancy Life expectancy is one of the most widely misunderstood concepts in retirement planning. It is often quoted as a single number—a statistical average—but this simplification obscures the complexity of individual survival probabilities. For retirees, this misunderstanding can lead to miscalcu- lations about how long their savings need to…

Read MoreNavigating Australia’s Economic Crossroads

RESILIENCE, REFORM, AND THE ROLE OF PREFERENCE VOTES Introduction: Setting the Stage Australia finds itself at a critical juncture. The nation’s economy, while resilient in many respects, faces mounting pressures from stagnant real income growth, rising costs of living, and declining productivity. These challenges have been compounded by global uncertain- ties, including geopolitical tensions and…

Read More