Superannuation

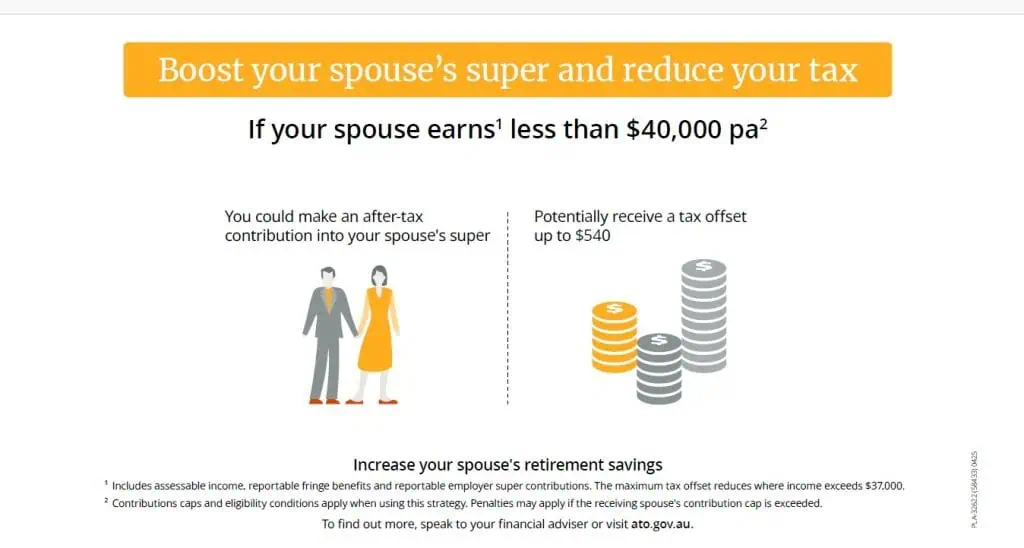

Super strategies – Splitting your super contributions to your spouse

Splitting super contributions to your spouse’s super account may help to boost their retirement savingsand provide a range of other benefits. How does the strategy work? You may be able to split (transfer) eligible concessional contributions (CCs) that you’ve made or received to your spouse’s super account. Eligible CCs include employer super contributions and personal…

Read MoreSuper strategies – Topping up super with ‘catch-up’ contributions

If you have not fully used your concessional cap in a prior financial year, youmay be eligible to use these unused carried forward amounts in a later year.Depending on your circumstances, this could help you to maximise tax‑effective super contributions and invest more for retirement. How does the strategy work? If your concessional contributions (CCs)…

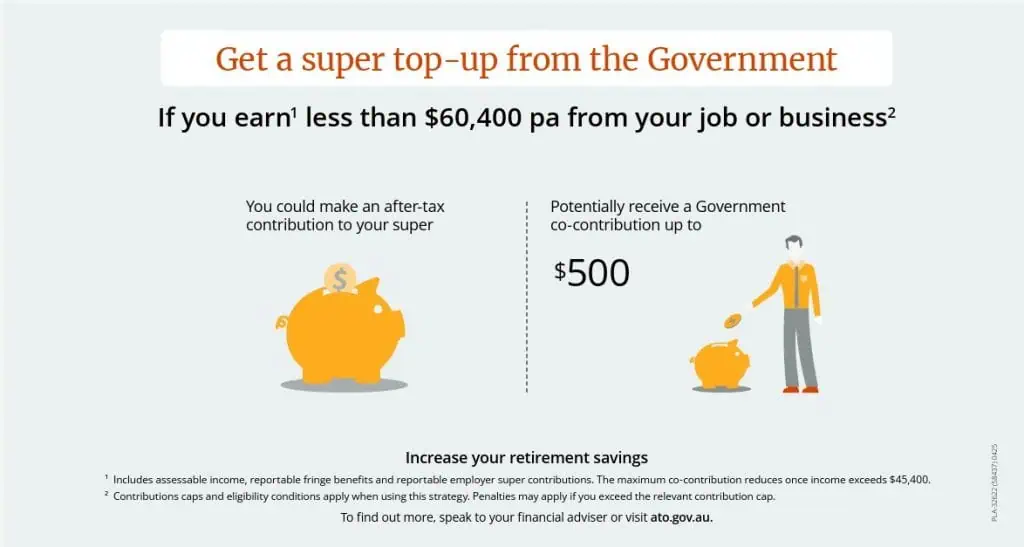

Read MoreSuper strategies – Top-up your super with help from the Government

If your income is under a certain threshold, then making personal after-tax super contributions could enable you to qualify for a Governmentco-contribution and take advantage of the low tax rate payable in super on investment earnings. How does the strategy work? If you are under 71 at the end of the financial year, earn1 less…

Read MoreSuper strategies – Sacrifice pre-tax salary into super

Contributing some of your pre‑tax salary, wages or a bonus into super could help you to reduce your tax and invest more for your retirement. How does the strategy work? With this strategy, known as salary sacrifice, you need to arrange for your employer to contribute some of your pre‑tax salary, wages or bonus directly…

Read MoreHOW TO THRIVE IN UNCERTAIN MARKETS

Understanding Market Volatility Market volatility is an inevitable part of investing, yet it often evokes fear and uncertainty among investors. The phrase “catching a falling knife” vividly captures the dangers of trying to time the market during sharp declines it suggests that attempting to buy assets during a precipitous drop can lead to painful losses.…

Read MoreSuperannuation Beneficiaries

Can I nominate my siblings to receive my superannuation when I die? can only nominate your siblings in a binding death benefit nomination if they meet the definition of a depen- dent under superannuation law at the time of your death. This means they would need to be financially dependent on you, in an interdependent…

Read MoreNavigating Financial Risks and Retirement

Introduction: The Changing Perception of Life Expectancy Life expectancy is one of the most widely misunderstood concepts in retirement planning. It is often quoted as a single number—a statistical average—but this simplification obscures the complexity of individual survival probabilities. For retirees, this misunderstanding can lead to miscalcu- lations about how long their savings need to…

Read MoreStrategies for a Secure Retirement In Australia

Introduction Retirement is a milestone that many Australians look forward to—a time to relax, pursue passions, and enjoy the fruits of decades of hard work. Yet, for Generation X (those born between 1965 and 1980), the path to a secure retire- ment is less certain than it was for their parents. Economic shifts, evolving superannuation…

Read MoreThe Silver Rule of Investing

“In the unpredictable world of investing, where the promise of high returns often dazzles, aquieter principle shines through: the “silver rule” of investing. Distinct from the “goldenrule” that encourages chasing profits, the silver rule is elegantly simple—win by not losing“ This philosophy centres on safeguarding your wealth rather than gambling it on speculative gains, a…

Read MoreSelf Employed – Are Super contributions Necessary?

I’m self-employed. What’s the best way to save for retirement when I don’t have my employer making super contributions like many others do? As a self-employed individual, you’re responsible for building your own retirement savings, which means planning carefully to ensure your future income is secure. You should aim to make contributions to super on…

Read More