GIVING WISELY

HOW TAX-SMART PHILANTHROPY BUILDS WEALTH AND COMMUNITY IN AUSTRALIA

Introduction: A New Era for everyday Australian Giving

Philanthropy in Australia is changing. It’s no longer just for the wealthy or for big corporations everyday Australians are discovering how giving can be both deeply rewarding and financially smart. With new government incentives and easier ways to donate, more people are finding that supporting their favourite causes can also help them manage their finances and build a lasting legacy for their families.

Whether you’re passionate about helping your local community, supporting medical research, or backing environmental projects, there are now more ways than ever to make your giving go further. This guide explains how you, as a retail client, can use tax-smart philanthropy to make a difference while also looking after your own financial well-being.

Why Structured Giving is Gaining Popularity

Moving Beyond One-Off Donations

Many Australians are used to giving a few dollars here and there—at the checkout, during a charity drive, or online. While every bit helps, there’s a growing trend towards “structured giving.” This means planning your donations in a way that’s more strategic, so you can:

- Support your chosen causes over the long term

- Maximise the impact of your gifts

- Take advantage of tax benefits

- Involve your family and pass on your values

National Push to Double Giving

The federal government wants to double philanthropic giving by 2030. To help achieve this, they’ve introduced reforms to make giving easier and more attractive for everyday people—not just high-net-worth individuals.

Understanding Your Options:

How Can You Give?

There are several ways you can structure your giving in Australia. Here are the most popular options for retail clients:

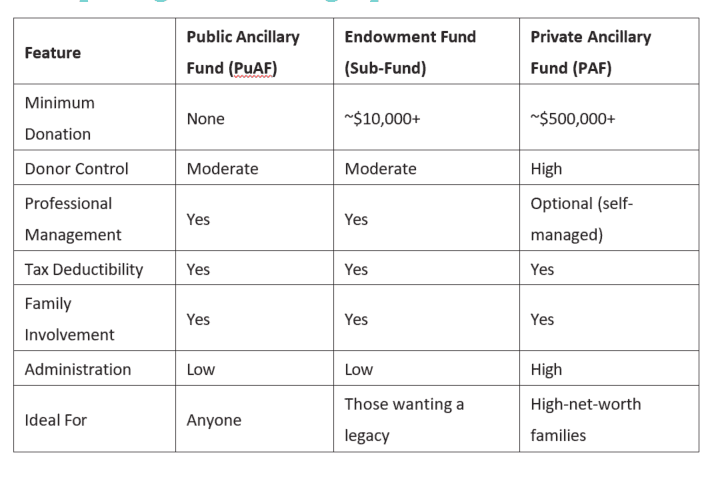

1. Public Ancillary Funds (PuAFs) What are they?

PuAFs are managed funds that pool donations from many people. You can contribute any amount, and the fund’s managers handle all the paperwork, investments, and compliance.

Why consider a PuAF?

- No minimum donation—start with what you can afford

- Donations are tax-deductible if the fund is a Deductible Gift Recipient (DGR)

- You can set up a “sub-fund” in your name or your fami- ly’s name for a personal touch

- The fund distributes at least 4% of its assets each year to eligible charities

Who is it for?

Anyone who wants a simple, flexible, and professionally managed way to give.

2. Endowment Funds (Sub-Funds) What are they?

Often set up as part of a PuAF, endowment funds let you make an initial donation (sometimes as low as $10,000) and then recommend which charities receive grants from your fund’s income each year.

Why consider an endowment fund?

- Create a named legacy for your family or a cause

- Your donation is invested, and only the earnings are dis- tributed each year—so your impact continues over time

- Tax-deductible donations, with the option to spread de- ductions over several years if you make a large gift

Who is it for?

People who want to support their favourite causes for years to come, with minimal administration.

3. Private Ancillary Funds (PAFs) What are they?

PAFs are private charitable trusts, usually set up by families or individuals who want to give large amounts (typically $500,000 or more). You control the investments and decide which charities receive grants, but you’re also responsible for compliance and reporting.

Why consider a PAF?

- Maximum control over how your money is invested and given

- Involve your family in decision-making and create a tradition of giving

- Tax-deductible donations and tax-free investment earnings

Who is it for?

Those with significant resources who want to create a family foundation and manage their own giving.

Making Your Giving Work for You: Tax Benefits and Compliance

How Tax-Deductible Giving Works

When you donate to a charity or fund with DGR status, you can claim a tax deduction for your gift. This means you pay less tax, while your chosen charity receives more support. For larger gifts, you can spread your deduction over up to five years—helpful if you want to manage your taxable income.

Checklist for Tax-Deductible Giving:

- Make sure the charity or fund has DGR status (check the ATO website)

- Keep your receipts and records

- Consider timing your donation for maximum tax benefit (e.g., in a high-income year)

- For gifts over $5,000, talk to your accountant about spreading deductions

New Reforms to Make Giving Easier

Recent government changes are making it simpler for all Australians to give:

- No more $2 minimum: Soon, all donations—no matter how small—will be eligible for a tax deduction

- Simpler DGR processes: More charities can now receive tax-deductible gifts, especially community and grass- roots groups

- Easier reporting: Funds and charities face less red tape, so your donation goes further

Practical Strategies for Everyday Givers

1. Start Small, Grow Over Time

You don’t need to be wealthy to make a difference. Many Australians start with small, regular donations—either directly to charities or through a PuAF or endowment fund. Over time, these gifts add up and can have a big impact.

2. Involve Your Family

Giving can be a powerful way to teach children about values and community. Consider involving your family in choosing causes, setting up a sub-fund, or volunteering together.

3. Review Your Giving Regularly

As your circumstances change, so can your giving.

Review your donations each year to make sure they still align with your values and financial goals.

4. Use Workplace Giving and Matching

Some employers offer workplace giving programs or match employee donations. This can double the impact of your gift with no extra cost to you.

5. Seek Professional Guidance for Larger Gifts

If you’re considering a significant donation or setting up a fund, speak with a financial adviser or accountant. They can help you structure your giving for maximum impact and tax effectiveness.

Building a Legacy: The Deeper Value of Giving

Philanthropy isn’t just about money—it’s about building a legacy and strengthening your connection to the communi- ty. Many Australians find that structured giving brings:

- A sense of purpose and fulfilment

- Opportunities to involve family and pass on values

- Stronger ties to community groups and causes

- The satisfaction of seeing real, long-term impact Research shows that people who give regularly often report higher life satisfaction and financial well-being.

Frequently Asked Questions

What is a Deductible Gift Recipient (DGR)?

A DGR is a charity or fund approved by the government to receive tax-deductible donations. Always check a char- ity’s DGR status before donating if you want to claim a deduction.

Can I choose which charities my fund supports?

Yes. With PuAFs and endowment funds, you can recom- mend grants to your favourite charities. With a PAF, you have full control over grant-making (within legal guidelines).

Are there limits on how much I can claim as a tax deduc- tion?

There’s no upper limit, but deductions can’t create a tax loss. Any unused deductions can be carried forward for up to five years.

What records do I need to keep?

Keep receipts for all donations and any correspondence with charities or funds. This will make tax time easier and ensure you can claim your deductions.

Comparing Your Giving Options

Conclusion: Giving That Makes Sense for You

Tax-smart philanthropy is not just for the wealthy or financial experts. With new reforms and more flexible options, every Australian can support the causes they care about—while also enjoying real financial benefits. Whether you choose to give directly, set up a sub-fund, or even create a family foundation, structured giving can help you make a bigger difference, build a legacy, and achieve your own financial goals.

If you’re ready to take the next step, start by exploring PuAFs or endowment funds, talk to your favourite charities about DGR status, or seek advice for larger gifts. The most important thing is to begin—your giving can change lives, including your own.

References

- Australian Taxation Office. (2025, July). Philanthropy – support to double philanthropic giving by 2030.

- Philanthropy Australia. (2025, March). DGR tax reforms to bring ‘new era’ for community foundations.

- ifa. (2025, June). How philanthropy can be a ‘tax-smart strategy’.

- UNICEF Australia. (2025, May). Tax deductible donations – Everything you need to know in 2025.

- Australian Philanthropic Services. (2025, May). Private ancillary funds (PAFs) – Strategic & inspiring philanthropy.

- Australian Charities and Not-for-profits Commission. (2025). Guidance on ancillary funds.

- Swinburne University Centre for Social Impact. (2024). Research on philanthropy and financial well-being.

- Giving Australia Report. (2024). National trends in charitable giving.