Posts Tagged ‘tax’

Wealth, Wisdom, and Wellbeing: How End-of-Year Super Planning Can Secure Your Future

As the end of the financial year approaches, Australians are presented with a unique opportunity to take stock of their financial health and make decisions that can shape their future. Superannuation, the cornerstone of retirement planning in Australia, is at the heart of this process. The period leading up to June 30 is not just…

Read MoreSpouse Contributions: Looking for ways to boost your super?

My spouse and I are looking at ways to boost our super. How do spouse contributions and the associated tax offset work? Spouse contributions can be a great way to build your partner’s superannuation and potentially benefit from a tax offset. If your spouse earns less than $37,000 a year, you may be eligible for…

Read MoreSmart Super Strategies for this EOFY

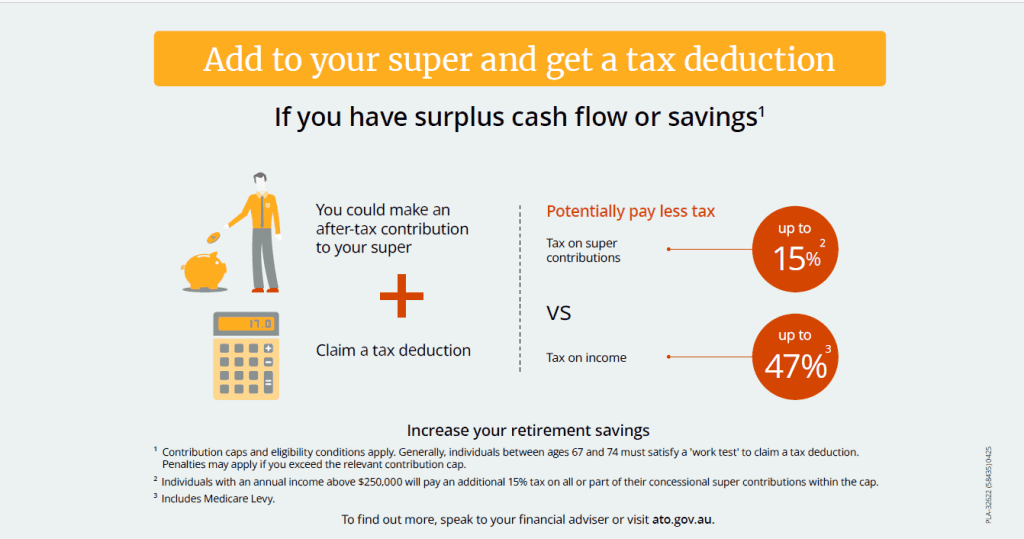

With June 30 fast approaching, it’s time to start thinking about your super for another year. We’ve put together five smart strategies that may benefit you now, and help boost your super. Strategy This may be right if you……. How to use this strategy The benefits may include 1. Add to your super and get…

Read MoreSuper strategies; Make tax-deductible super contributions

By making a personal super contribution and claiming the amount as a tax deduction, you may be able to pay less tax and invest more in super. How does the strategy work? If you make a personal super contribution, you may be able to claim the contribution as a tax deduction and reduce your taxable…

Read MoreFinancial New Year’s resolutions for peace of mind

You know all those niggling anxieties about your finances that often lurk somewhere in the back of your mind? You know the ones… Do I have enough insurance cover? Is my super organised properly? Am I paying too much on the 32,496,357 bills that seem to keep flooding my inbox every month? It’s time to…

Read MoreWhy we love and loathe #Budget2018

The Federal Budget was announced last week and has, once again, divided the opinions of Australian consumers. The use of data to benefit consumers seemed high on the Treasurer’s agenda, with a number of well-received initiatives to support control and privacy. But his measures to boost consumers’ personal finances were labelled modest and unfair by…

Read MoreWhy tax should be on your mind – all year long!

Written by Jason Robinson, Director at RBK Advisory. Tax planning are two words that get no one excited. But do you know what’s even less exciting? A big tax bill. Four words dreaded by every single business owner, family and individual. It’s time to change that deal-with-it-last-minute mindset, and begin to think of tax planning…

Read MoreTen things you're doing wrong at tax time

Let’s admit it. Putting together a tax return isn’t exactly something most people relish. But completed correctly, it can be one of the largest lump sum payments some of us receive each year. So, it definitely pays to get it right! Unfortunately, though, not all of the 8.5 million or so Australians who submit a…

Read More