Create Wealth

Five ways to stick to your financial resolutions

Setting a financial goal for the New Year? Take Steps to make it work It’s that time of year when we set new goals or dust off old ones. But how can we boost our chances of sticking to our financial resolution? Here are some practical tips. 1. Choose an attainable goal It’s good to be ambitious, but you may…

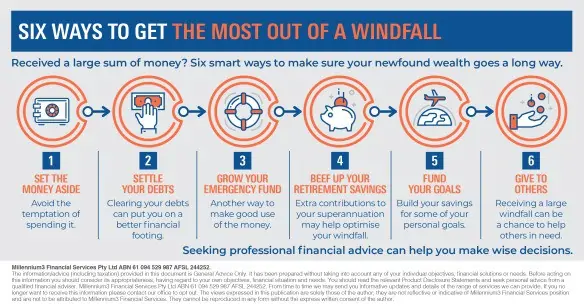

Read MorePut your financial windfall to good use

Received a large sum of money? By taking some practical steps, you can make sure your newfound wealth goes a long way. Windfalls such as salary bonuses and inheritances are more common than many people think. An Australian survey showed that 85% of seniors are likely to leave an inheritance for their children, with an estimated…

Read MoreWhat is adviser-led super?

Why should I care about lost super?

Did you know there is about 14.8 million Australians with a superannuation account, 40% of which hold more than one account? Some of that 40% make up the $18 billion in ‘lost super’. Is some of that yours? Find it Moved house? Changed jobs? Don’t know where your teenage self stashed your super? It’s easy…

Read MoreBudget Summary

The announcements in this update are proposals unless stated otherwise. These proposals need to successfully pass through Parliament before becoming law and may be subject to change during this process. What you need to know – Quick Summary The Budget is forecast to return to surplus in 2019/20 with a positive balance of $2.2bn The economic…

Read MoreHow to protect your assets from expensive mistakes

Protecting yourself from frivolous creditors and lawsuits is becoming an increasingly common concern. Here we outline some of the ways you can insulate your assets. Check your insurancesLiability insurance is a must if you want to safeguard your assets in the event that you need to pay compensation. Lawsuits can arise for a range of reasons –…

Read MorePlanning a Holiday? Here are some tips

With the summer holidays almost coming to an end, it’s not too late to do your financial planning for a last minute getaway – or start planning for 2019. Here’s how to minimise your financial stress for a well-deserved break.? Plan ahead The earlier you start planning, the more money you can save. And when it…

Read MoreIs everything secure before your break?

It’s that time of year when thoughts turn to relaxing with family and friends and perhaps getting away from it all. If you are going away you no doubt take care to lock the doors and windows, organise for mail and garbage bins to be checked and neighbours notified. But have you secured everything? There…

Read MoreFour Steps to a Bright Financial Future

Tackling your finances can be daunting. But you can’t put a price on the peace of mind you’ll get knowing exactly what is happening with your money – and making a start is easier than you might think. You can take control of your financial future with a few simple steps. 1. Create a…

Read More5 Ways Money May be Slipping Through Your Fingers

Is your money slipping through the cracks? Discover 5 ways you’re unknowingly losing money & how to stop it. Read now for financial habits.

Read More