Superannuation

Navigating Resilient Retirement

Introduction: The Legacy and Limits of the 4% Rule When Bill Bengen first delved into the mathematics of spending in retirement, his aim was to answer a deceptively simple question: how much can you safely draw from your investments each year and never run out of money? After studying a range of portfolios and market…

Read MoreCompounding Interest

HOW COMPOUNDING BUILDS WEALTH FOR EVERY AUSTRALIAN Introduction: Why Compounding Is the One Investing Principle Everyone Must Know“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” These words, often attributed to Einstein, echo across generations for a reason. More than any market “secret,” compounding…

Read MoreWHY YOUR FUTURE SELF WILL THANK YOU

UNDERSTANDING THE TIME VALUE OF MONEY IN EVERYDAY AUSTRALIAN LIFE Introduction: The Invisible Power of Time in Personal Finance Imagine being faced with a simple choice: you can have $100 today or $120 if you’re willing to wait a year. The rational response may seem obvious wait for the higher pay out. Yet, most people…

Read MoreSUPER SPLITTING

GROW YOUR WEALTH TOGETHER Introduction: Why Super Splitting Matters for Australian Families When it comes to preparing for retirement, many Australians focus on growing their superannuation individually. But what if there was a way for couples to work together, sharing their super contributions to build a stronger financial future? This is where superannuation contribution splitting—commonly…

Read MoreResilience and Reality – Understanding V-Shaped market Recoveries and what they mean for your wealth

Introduction: The Allure and Myth of V-Shaped Recoveries In the world of investing, few images are as reassuring—or as captivating—as the so-called “V-shaped” market recovery. The idea is simple: after a sharp downturn, markets bounce back just as quickly, restoring lost wealth and confidence almost overnight. For many Australians, especially in the wake of recent…

Read MoreWealth, Wisdom, and Wellbeing: How End-of-Year Super Planning Can Secure Your Future

As the end of the financial year approaches, Australians are presented with a unique opportunity to take stock of their financial health and make decisions that can shape their future. Superannuation, the cornerstone of retirement planning in Australia, is at the heart of this process. The period leading up to June 30 is not just…

Read MoreSpouse Contributions: Looking for ways to boost your super?

My spouse and I are looking at ways to boost our super. How do spouse contributions and the associated tax offset work? Spouse contributions can be a great way to build your partner’s superannuation and potentially benefit from a tax offset. If your spouse earns less than $37,000 a year, you may be eligible for…

Read MoreThe Art and Science of Fund Manager Selection

Balancing Philosophy, Performance and Investor Resilience Introduction: The Importance of Choosing the Right Fund Manager For Australian investors, selecting a fund manager is one of the most consequential decisions in the journey toward financial security. The right manager can help navigate volatile markets, safeguard capital, and deliver consistent returns, while the wrong choice can erode…

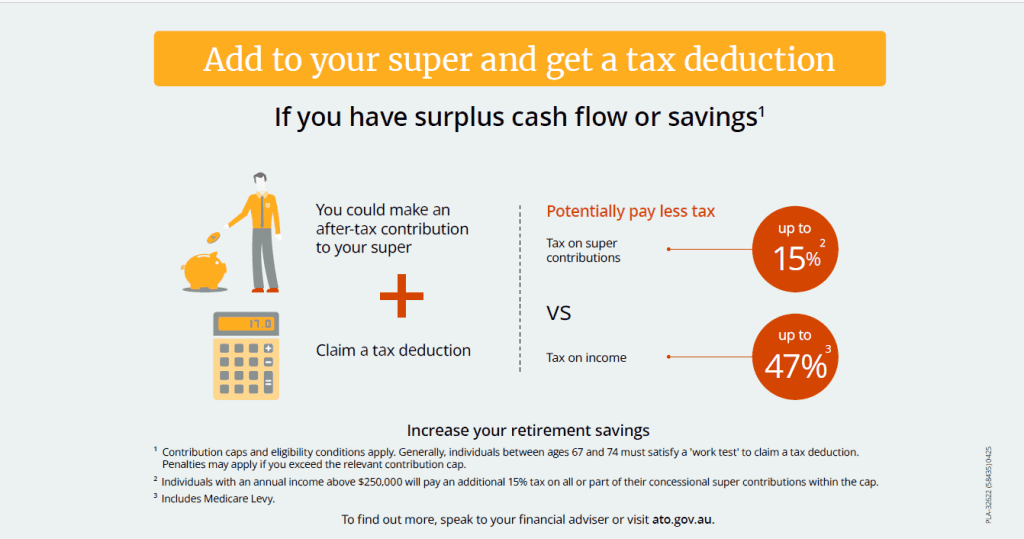

Read MoreSmart Super Strategies for this EOFY

With June 30 fast approaching, it’s time to start thinking about your super for another year. We’ve put together five smart strategies that may benefit you now, and help boost your super. Strategy This may be right if you……. How to use this strategy The benefits may include 1. Add to your super and get…

Read MoreSuper strategies; Make tax-deductible super contributions

By making a personal super contribution and claiming the amount as a tax deduction, you may be able to pay less tax and invest more in super. How does the strategy work? If you make a personal super contribution, you may be able to claim the contribution as a tax deduction and reduce your taxable…

Read More