Super strategies; Make tax-deductible super contributions

By making a personal super contribution and claiming the amount as a tax deduction, you may be able to pay less tax and invest more in super.

How does the strategy work?

If you make a personal super contribution, you may be able to claim the contribution as a tax deduction and reduce your taxable income.

The contribution will generally be taxed in the fund at the concessional rate of up to 15%1, instead of your marginal tax rate which could be up to 47%^.

Depending on your circumstances, this strategy could result in a tax saving of up to 32% and enable you to increase your super.

To be eligible to claim the super contribution as a tax deduction, you need to submit a valid ‘Notice of Intent’ form

to your super fund within required time frames. You will also need to receive an acknowledgement from the super fund before you complete your tax return, start a pension, withdraw or rollover money from the fund to which you made your personal contribution.

It is generally not tax-effective to claim a tax deduction for an amount that reduces your assessable income below your tax free threshold. This is because you would end up paying more tax on the super contribution than you would save from claiming the deduction.

Key considerations

- Personal deductible contributions count towards your ‘concessional contribution’ cap. This cap is $30,000 in FY 2024/25, or may be higher if you didn’t contribute your full concessional contribution cap in any of the previous five financial years and are eligible to make ‘catch-up’ contributions. Tax implications and penalties may apply if you exceed your cap.

- You can’t access super until you meet certain conditions.

- If you are an employee, another way you may be able to grow your super tax effectively is to make salary sacrifice contributions (see case study).

Seek advice

To find out whether you could benefit from this strategy, you should speak to a financial adviser and a registered tax agent.

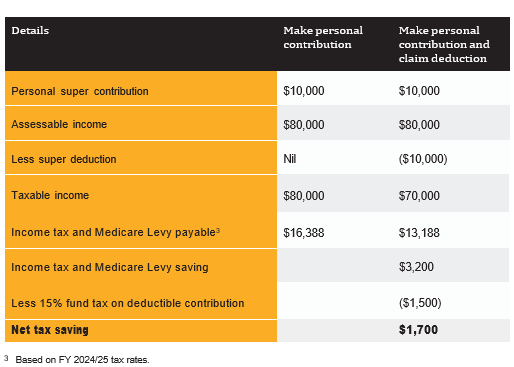

Bob, aged 55, is self-employed, earns $80,000 pa and pays tax at a marginal rate of 32% (including the Medicare levy)^^.

He plans to retire in 10 years and wants to boost his retirement savings.

After speaking to a financial adviser, he decides to make a personal super contribution of $10,000 and claim the amount as a

tax deduction.

By using this strategy, he’ll increase his super balance. Also, by claiming the contribution as a tax deduction, the net tax saving will be $1,700.

If the tax deduction is claimed on the personal contribution, $8,500 (contribution net of tax withheld) is invested in super.

If no deduction is claimed, $10,000 is invested in super. However, no tax savings are applied to Bob’s income tax assessment for the relevant year.

Salary sacrifice contributions

If you are an employee, you may want to arrange with your employer to contribute some of your pre-tax salary into super.

This is known as ‘salary sacrifice’.

Like making personal deductible contributions, salary sacrifice may enable you to boost your super tax-effectively. There are, however, a range of issues you should consider before deciding to use this strategy.

Your financial adviser can help you determine whether you should consider salary sacrifice instead of (or in addition to) making personal deductible contributions.

You may also want to ask your financial adviser for a copy of our super concept card, called ‘Sacrifice pre-tax salary into super’.

^ Individuals with income above $250,000 in FY 2024/25 will pay an additional 15% tax on personal deductible and other concessional super contributions.

^^ Includes Medicare levy.

The information in this communication is factual in nature. It reflects our understanding of existing legislation, proposed legislation, rulings etc as at the date of issue (14 March 2025), and may be subject to change. While it is believed the information is accurate and reliable, this is not guaranteed in any way. Examples are illustrative only and are subject to the assumptions and qualifications disclosed. Whilst care has been taken in preparing the content, no liability is accepted for any errors or omissions in this communication, and/or losses or liabilities arising from any reliance on this communication.