Posts Tagged ‘financial advice’

How to Save Money: Practical Tips for Building Financial Security

Do you ever feel like your money disappears as soon as you get paid? In today’s economy, learning how to save money is more important than ever. With rising living costs in Australia, many people struggle to stay ahead. Saving isn’t just about having extra cash, it’s about building financial security and peace of mind.…

Read MoreSpouse Contributions: Looking for ways to boost your super?

My spouse and I are looking at ways to boost our super. How do spouse contributions and the associated tax offset work? Spouse contributions can be a great way to build your partner’s superannuation and potentially benefit from a tax offset. If your spouse earns less than $37,000 a year, you may be eligible for…

Read MoreThe Art and Science of Fund Manager Selection

Balancing Philosophy, Performance and Investor Resilience Introduction: The Importance of Choosing the Right Fund Manager For Australian investors, selecting a fund manager is one of the most consequential decisions in the journey toward financial security. The right manager can help navigate volatile markets, safeguard capital, and deliver consistent returns, while the wrong choice can erode…

Read MoreFAMILY TRUSTS AND RELATIONSHIP BREAKDOWNS

NAVIGATING ASSET PROTECTION, LEAGAL REALITIES AND RESILIENT WEALTH MANAGEMENT Introduction: The Rise of Family Trusts and the Challenge of Relationship Breakdowns Family trusts have become a cornerstone of wealth management in Australia, valued for their flexibility, tax efficiency, and capacity to facilitate intergenerational wealth transfer. As families grow more financially sophisticated, advisers are increasingly turning…

Read MoreSHELTER, SECURITY AND THE AUSTRALIAN DREAM

UNPACKING THE HOUSING CRISIS AND PATHS TO RESILIENCE Introduction: The Australian Dream in Crisis For generations, the “Australian Dream” has been synonymous with home ownership-a symbol of stability, personal achievement, and intergenerational security. Yet, in 2025, this dream is under threat as Australia faces a housing crisis of unprecedented scale and complexity. The sharp decline…

Read MoreSmart Super Strategies for this EOFY

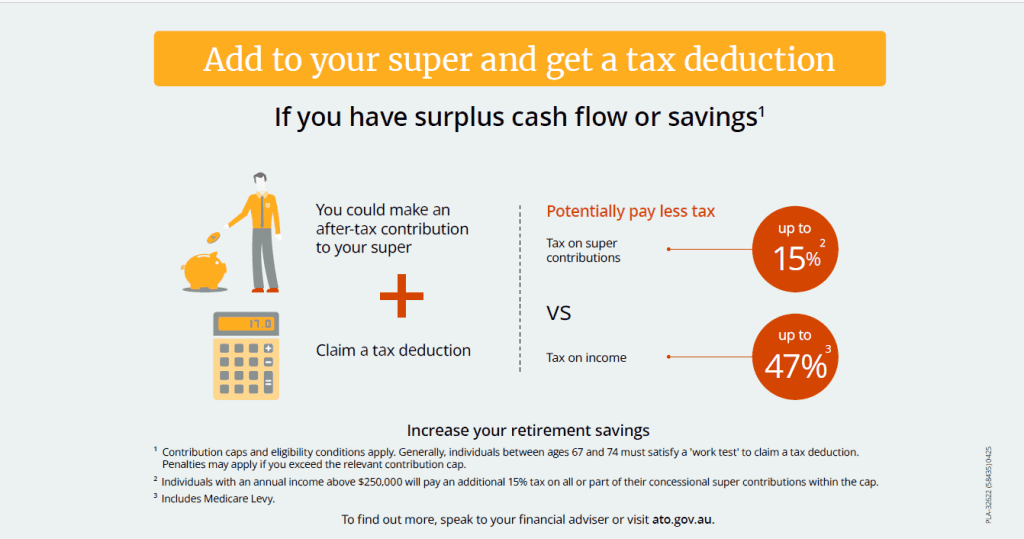

With June 30 fast approaching, it’s time to start thinking about your super for another year. We’ve put together five smart strategies that may benefit you now, and help boost your super. Strategy This may be right if you……. How to use this strategy The benefits may include 1. Add to your super and get…

Read MoreSuper strategies; Make tax-deductible super contributions

By making a personal super contribution and claiming the amount as a tax deduction, you may be able to pay less tax and invest more in super. How does the strategy work? If you make a personal super contribution, you may be able to claim the contribution as a tax deduction and reduce your taxable…

Read MoreFederal Election 2025 – What this could mean for you and your finances?

During the Federal Election campaign, the Government made a number of election promises, which may impact finances. There were also a number of support measures proposed in the recent Federal Budget. What could this mean for you? These announcements are proposals only and may or may not be made law. The information below, including the…

Read MoreWomen and Trauma Insurance: Ensuring Financial Support Amidst Health Challenges

Navigating the complexities of health challenges can be overwhelming, but having a safety net like trauma insurance can make a world of difference. As claims for women’s breast cancer continue to rise, understanding the importance of trauma insurance becomes essential. This coverage provides crucial financial support, ensuring that those affected can focus on recovery without…

Read MoreFrom Research to Reality: A Supportive Guide to Investing in Residential Properties

Investing in residential properties can seem daunting at first, but with the right guidance, it becomes an exciting and rewarding journey. Whether you’re a young family seeking to build a secure future or an individual exploring new financial opportunities, understanding the essentials of residential property investment is key. By focusing on strategic real estate market…

Read More