Posts Tagged ‘Superannuation’

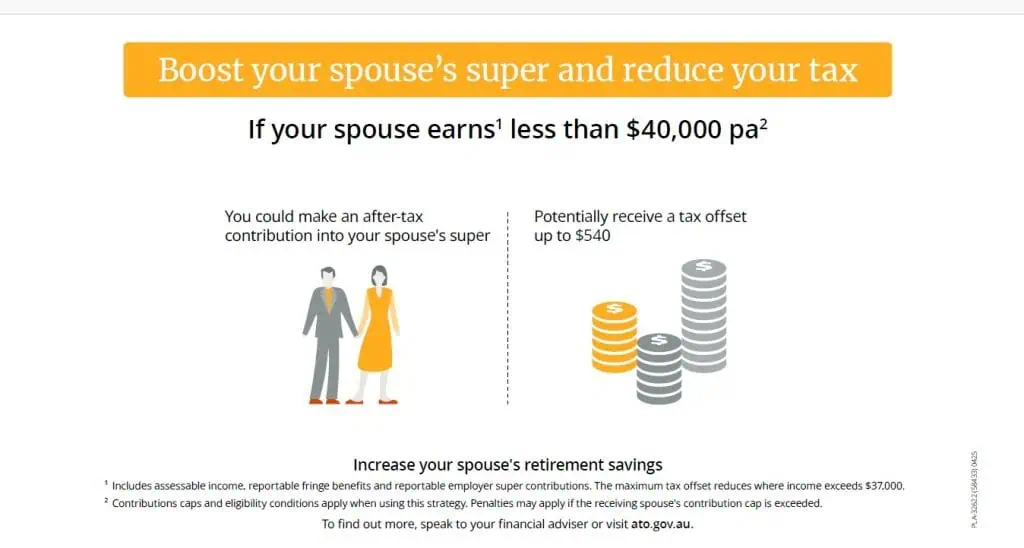

Super strategies – Splitting your super contributions to your spouse

Splitting super contributions to your spouse’s super account may help to boost their retirement savingsand provide a range of other benefits. How does the strategy work? You may be able to split (transfer) eligible concessional contributions (CCs) that you’ve made or received to your spouse’s super account. Eligible CCs include employer super contributions and personal…

Read MoreSuper strategies – Topping up super with ‘catch-up’ contributions

If you have not fully used your concessional cap in a prior financial year, youmay be eligible to use these unused carried forward amounts in a later year.Depending on your circumstances, this could help you to maximise tax‑effective super contributions and invest more for retirement. How does the strategy work? If your concessional contributions (CCs)…

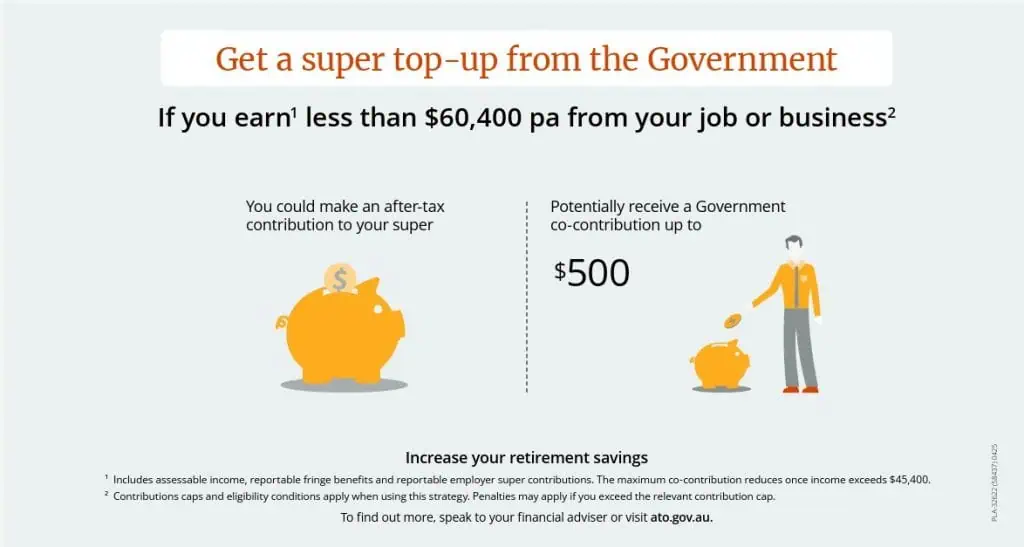

Read MoreSuper strategies – Top-up your super with help from the Government

If your income is under a certain threshold, then making personal after-tax super contributions could enable you to qualify for a Governmentco-contribution and take advantage of the low tax rate payable in super on investment earnings. How does the strategy work? If you are under 71 at the end of the financial year, earn1 less…

Read MoreSuper strategies – Sacrifice pre-tax salary into super

Contributing some of your pre‑tax salary, wages or a bonus into super could help you to reduce your tax and invest more for your retirement. How does the strategy work? With this strategy, known as salary sacrifice, you need to arrange for your employer to contribute some of your pre‑tax salary, wages or bonus directly…

Read MoreSuperannuation Beneficiaries

Can I nominate my siblings to receive my superannuation when I die? can only nominate your siblings in a binding death benefit nomination if they meet the definition of a depen- dent under superannuation law at the time of your death. This means they would need to be financially dependent on you, in an interdependent…

Read MoreSelf Employed – Are Super contributions Necessary?

I’m self-employed. What’s the best way to save for retirement when I don’t have my employer making super contributions like many others do? As a self-employed individual, you’re responsible for building your own retirement savings, which means planning carefully to ensure your future income is secure. You should aim to make contributions to super on…

Read MoreUnlocking the Power of SMSFs

A Family’s Guide to Superannuation Control and Flexibility Navigating the world of superannuation can often feel like charting unknown waters, especially for families looking to make informed financial decisions. Self-managed super funds (SMSFs) offer a unique opportunity for those seeking superannuation control and flexibility, allowing families to pool their resources and tailor investment choices to…

Read MoreThe Evolution of Retirement Planning

This article will explore the key changes in superannuation thresholds, delve into the complexities of investment risk in superannuation, and examine emerging retirement income strategies.

Read MoreDownsizer Contributions to Super

Since July 2018 thousands of people have taken advantage of the Government’s downsizer contribution scheme by selling their home and making contributions to their super. This has allowed older Australians to have more money to fund their retirement.Although this is good news for people who have benefited from this scheme, some people may have missed…

Read MoreFinancial New Year’s resolutions for peace of mind

You know all those niggling anxieties about your finances that often lurk somewhere in the back of your mind? You know the ones… Do I have enough insurance cover? Is my super organised properly? Am I paying too much on the 32,496,357 bills that seem to keep flooding my inbox every month? It’s time to…

Read More